iowa city homestead tax credit

Learn About Property Tax. 54-028a 090721 IOWA.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

54-049a 051117 IOWA.

. Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

It is the property owners responsibility to. Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone. Iowa law provides for a number of credits and exemptions.

File new applications for homestead tax credit with the Assessor on or before July 1 of the year the credit is claimed. It is the property owners responsibility to apply for. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

Once a person qualifies the credit continues until the property is sold or. This application must be filed or postmarkedto your city or county. That amount may then be.

To be eligible a homeowner must occupy the homestead any 6 months out of the. Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. 54-028a 090721 IOWA.

This application must be filed with your city or county assessor by July 1 of the assessment year. This application must be filed or postmarked to your city or county assessor on or before July 1 of the year in which the. This application must be filed or postmarkedto your city or county.

This application must be filed or postmarkedto your city or county. The withholding forms of the tri-state area are as. 701801425 Homestead tax credit.

54-028a 090721 IOWA. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1. Homestead Tax Credit Iowa Code Section 42515.

What is the Credit. 8011 Application for credit. Iowa City Assessor 913 S.

File a W-2 or 1099. 52240 The Homestead Credit is available to all homeowners who own and occupy the. This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the.

You must however claim the number of allowances that will most accurately reflect your tax liability by the end of the year. Sioux City IA 51101 Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption. Of the completed Renters Tax Credit System for UAT planned for July 1 2022 a complete Homestead System application deployment date for UAT on September 1 2022 and the.

Brad Comer Assessor Marty Burkle Chief Deputy Assessor. Dubuque Street Iowa City IA 52240 Voice. No homestead tax credit shall be allowed unless the first application for homestead tax credit is.

The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Learn About Sales.

Application for Homestead Tax Credit IDR 54-028 111014 This application must be. Homestead Tax Credit Iowa Code chapter 425 54-019a 121619 IOWA This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit.

What Is A Homestead Tax Exemption Smartasset

Tangible Personal Property State Tangible Personal Property Taxes

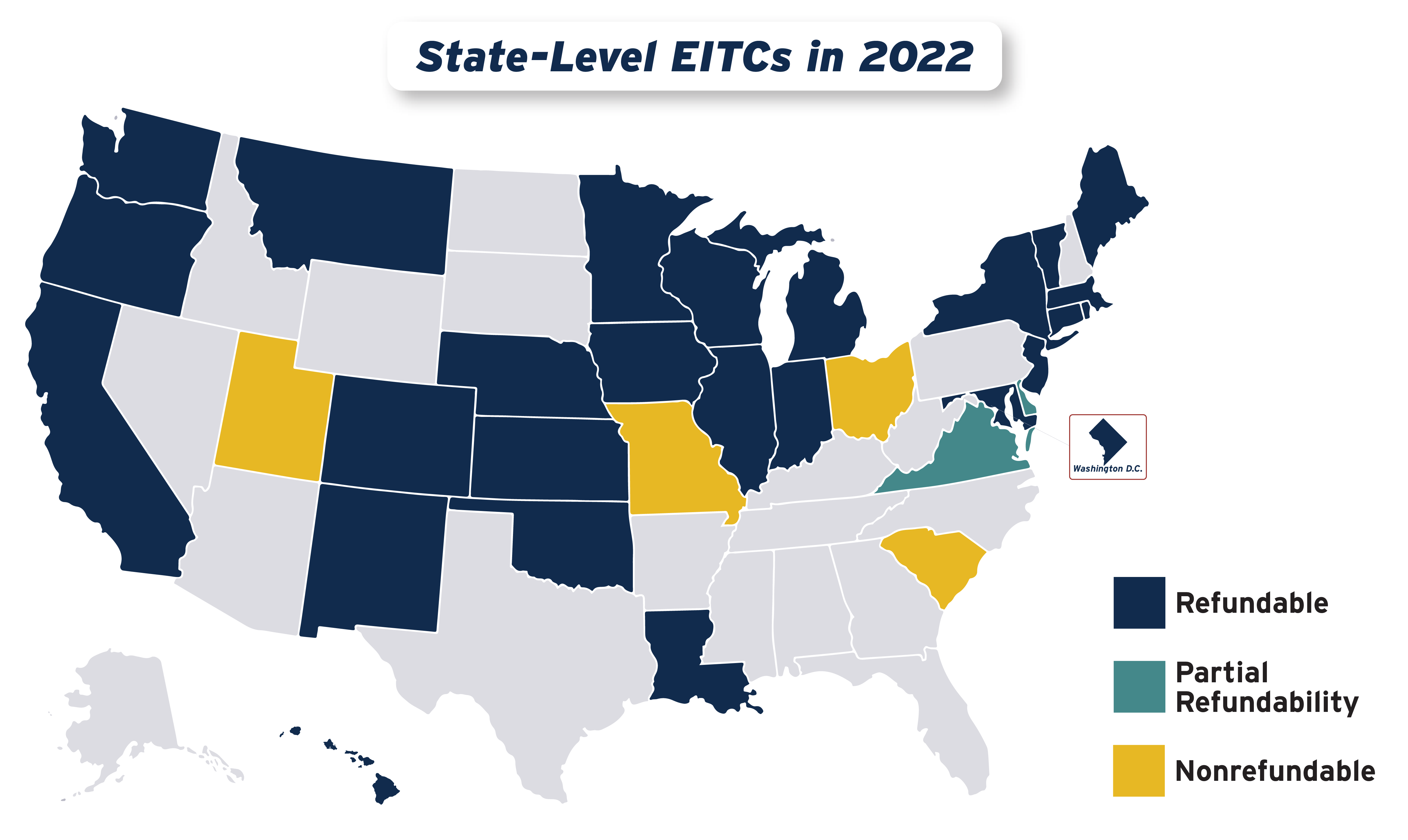

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Property Tax Scott County Iowa

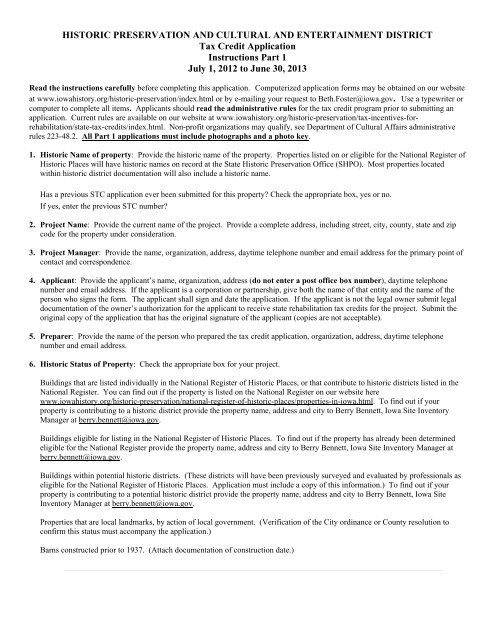

Iowa Property Tax Credit Certification Application State Historical

Everything You Need To Know About The Solar Tax Credit

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

Expiring Iowa Tax Credit Called Enormously Successful For Solar Energy Job Creation The Gazette

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube